Latest Share Price

About Us

Browse

About Us

History

Australian United Investment Company Limited (AUI) is a listed investment company which specialises in Australian listed equities. AUI was founded in 1953 by the late Sir Ian Potter. The Ian Potter Foundation Ltd continues to remain the Company’s largest single shareholder.

Objectives

AUI’s investment objectives are:

- To create and maintain a diversified portfolio of quality Australian companies, primarily through shares listed on the ASX, with a medium to long term view of providing income and capital appreciation;

- To manage the portfolio to monitor and reduce risks and identify market opportunities as they arise; and

- To provide dividend income to shareholders which is sustainable over the long-term, maintaining full franking when possible.

Process

AUI takes a disciplined approach to investing by utilising the wealth of experience of its Board of Directors. The investment portfolio is actively managed and maintained through regular meetings with investee companies, critical assessment of external research and by employing the extensive industry knowledge and expertise of its Board.

AUI is a long-term investor. When assessing whether an investment is appropriate for the portfolio, factors which are considered include:

- Industry outlook;

- Position of the company in its industry;

- Earnings Per Share (EPS) growth potential;

- Yield and franking;

- Management strength and alignment with shareholder returns;

- Balance sheet strength; and

- Environment, Social and Governance (ESG).

AUI is internally managed, allowing us to keep costs low and to maintain a low management expense ratio (MER). No performance fees are charged. Expenses are deducted before declaration of dividends.

Performance

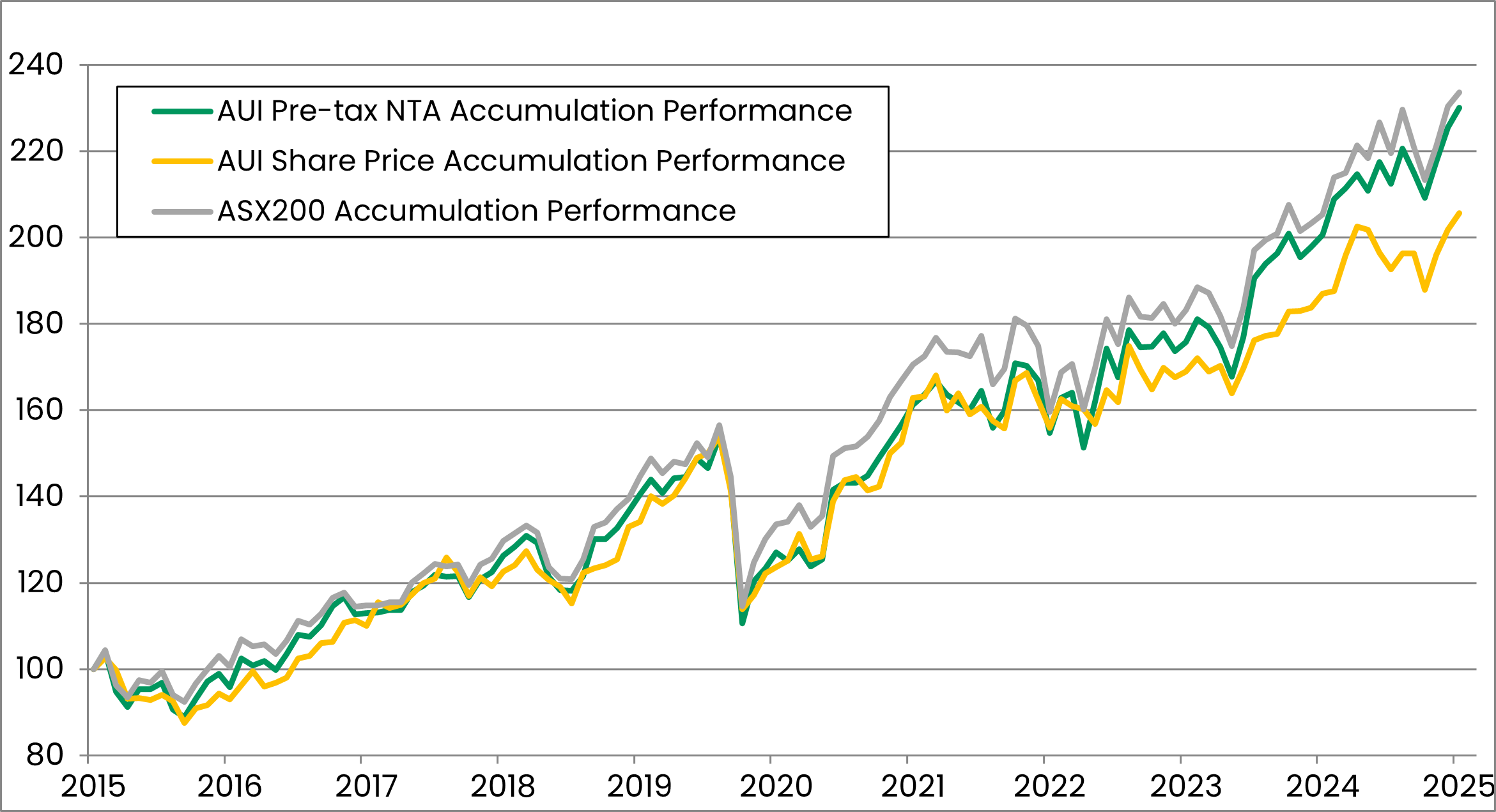

The following graph shows the accumulation performance of the Company’s net asset backing (before provision for tax on unrealised gains) and the Company’s share price performance, assuming in both cases that all dividends were reinvested, and the S&P/ASX 200 Accumulation Index, over the last ten years.

AUI Accumulated Investment Return vs S&P/ASX 200 Accumulation Index

(Excluding the Benefit of Franking Credits)

10 Years to 30 June 2025

Source: Evans and Partners

The following graph shows the Company’s historical share price.

The Company’s performance in recent years (assuming all dividends were reinvested) to 30 June 2025 is as follows:

| AUI Net Asset Backing Accumulation | AUI Share Price Accumulation | S&P/ASX200 Accumulation Index | |

|---|---|---|---|

| % p.a. | % p.a. | % p.a. | |

| 1 Year | 14.7 | 10.0 | 13.8 |

| 3 Years | 14.1 | 9.7 | 13.6 |

| 5 Years | 12.6 | 10.7 | 11.8 |

| 10 Years | 8.7 | 7.5 | 8.9 |

Board and Management

Charles Goode AC

B.Com (Hons) (Melb), MBA (Columbia), Hon LLD (Melb), Hon LLD (Mon)

Non‑executive Chairman, appointed April 1990 (Chairman since October 1993)

Mr Goode is the Chairman of the Board of Diversified United Investment Limited (since 1991), Chairman Emeritus of The Ian Potter Foundation Limited (having been Governor 1987 – 2024, Chairman 1994 – 2024) and Chairman Emeritus of Flagstaff Partners (having been Chairman 2010 – 2019).

Mr Goode was formerly Chairman of Australia and New Zealand Banking Group Limited (Director 1991 – 2010, Chairman 1996 – 2010) and Chairman of Woodside Petroleum Limited (Director 1988 – 2007, Chairman 1999 – 2007).

Fred Grimwade

B.Com/LLB (Hons) (Melb), MBA (Columbia), FAICD

Non-executive Director, appointed March 2014

Lead Independent Director, appointed October 2022

Mr Grimwade is a Principal and Director of Fawkner Capital Management Pty Ltd. He is currently Chairman of XRF Scientific Limited (Director since 2012, Chairman since 2018) and was previously Chairman / Director of CPT Global Limited (2002 – 2023) and a Director of Select Harvests Limited (2010 – 2023). Formerly he held senior executive positions with Colonial First State Investments Group, Colonial Mutual Group, Western Mining Corporation and Goldman, Sachs & Co. He is the Chairman of the Company’s Audit and Risk Management Committee.

Dion Hershan

B.Com/B.A. (Mon), MBA (Columbia)

Non-executive Director, appointed April 2018

Mr Hershan is Executive Chairman and Head of Australian Equities at Yarra Capital Management. He has more than 20 years’ finance industry experience. Formerly he held senior executive positions with Goldman Sachs Asset Management, Citadel Investment Group (New York), Fidelity Investments (Boston) and Boston Consulting Group. He is Chairman of the Company’s Nomination and Remuneration Committee.

Wayne Kent

B.Com/LLB (Melb), SF FIN

Non-executive Director, appointed November 2021

Mr Kent has a 40 year career spanning Law, Investment Banking and Private Equity, including extensive experience in the Australian and International markets. He is currently a Senior Adviser to Flagstaff Partners, an independent corporate finance advisory firm. He co-founded Macquarie’s Equity Capital Markets business and has held senior executive positions at Macquarie and Credit Suisse, Australia. He is also a co-owner or investor in a number of privately owned businesses and industrial properties in Australia.

James Pollard

CA, FGIA, B.BusCom (Mon), Grad Cert FP (Kaplan)

Company Secretary, appointed February 2020

Mr Pollard is also a Company Secretary of Diversified United Investment Ltd (since 2020), and has over a decade of experience in accounting, taxation and private wealth advisory.

Corporate Governance

AUI Corporate Governance Statement 2025

Constitution:

Board Committee Charters:

Audit and Risk Management Committee Charter

Nomination and Remuneration Committee Charter

Policies:

Anti-bribery and Corruption Policy